Home | Perspectives | The Evolving World of Indian Retail Business

The Retail sector has witnessed a roller coaster performance post the 1991 liberalization. The developments have been chaotic as the Organized sector went through a learning phase, simultaneously with the Government coming to grips with the regulatory challenges.

A. SIZE

Two economic metrics that attract the large Corporates within the Country and abroad are:

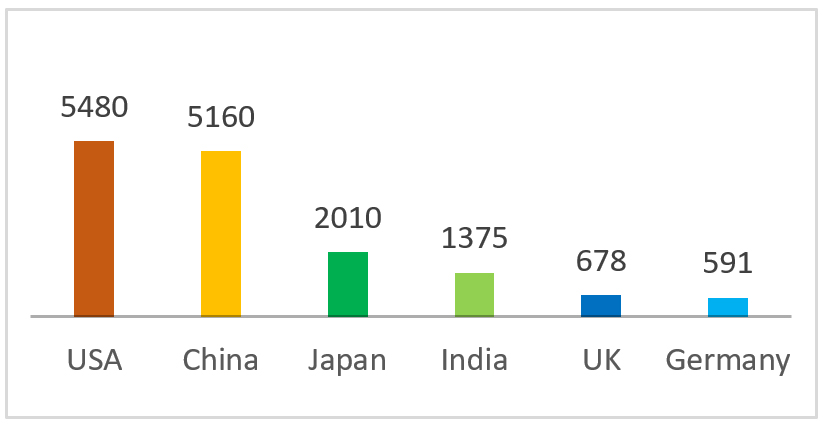

Top-5 Countries in Retail Segment 2025 ($Bn)

Per Capita GDP 2025 ($’000)

B. DIVERSITY

In keeping with the diversity of the country a number of formats are prevalent and all of them with growth potential

| No | Format | Items | Brands | The Buyers |

|---|---|---|---|---|

| 1 | Kirana (13Mn stores) | Daily essentials, Beverages | LIG/ MIG/Daily needs/ local | |

| 2 | Supermarket | Groceries, Dairies, Cleaning | Reliance Fresh | Weekly Shoppers |

| 3 | Department Store | Apparels, Cosmetics, Home Decor | Lifestyle, Shoppers Stop | Affluent/ Aspirational/ Urban |

| 4 | Hypermarket | Food, Apparel, Electronics, Home Goods | Best Price, Lulu, Reliance Mart | MIG/Planned/Value Conscious |

| 5 | Discount | General merchandise, off season items | D’Mart | MIG/Value Conscious / Monthly purchases |

| 6 | Specialty | Apparel, Books, Electronics | Croma, Fabindia, Decathlon, Ikea | HIG/Urban |

| 7 | Warehouse Club | Bulk Groceries, Appliances, Furniture | Metro | B2B |

| 8 | E-Commerce/ Q-Commerce | Amazon, Flipkart/ Blinkit/ Zapto/ Instamart | MIG, Urban/ HIG, Urban, SECA |

C. E-COMMERCE

In spite of the rapid growth of e Commerce both in rural and urban areas, it is expected to still remain a minor player even in 2030. There are a number of reasons for this situation.

D. A LARGE BUT COMPLEX MARKET

A market this big is an obvious one for the large MNCs. However, it is also a complex one and one is reminded of the early years in the automobile sector when two large US MNCs, entered India and left thereafter, failing to understand the market dynamics. Likewise in the retail sector too, there have been failures, with the reasons being other than lack of demand.

E. GOVERNMENT REGULATIONS

The Government has put in place guidelines for foreign entities both with respect to online (e-Commerce) and offline- brick and mortar outlets, with a view to support for the local traders. A distinction has been made between Single Branded Retail Outlets (SBRO) and the Multi Branded Retail Outlets (MBRO), setting minimum Investment and Deployment norms. There is a pause in new entrants, and in the interim a few large players from the corporate sector have consolidated operations attempting to gain leadership positions in specific geographies/formats. The market, however, is big enough to accommodate a few more MNCs

F. CRITICIAL SUCCESS FACTORS

The Kirana (Mom and Pop) format which is totally in the unorganized sector is still ranks first with respect to sales across all Formats. It dominates in the hyperlocal buyer category requiring staple groceries, vegetables and PBC. It is the first choice for the lower income group for whom need overshadows aspirations and “value” and “amount” of spend is critical.

Outside of this category as income levels and disposable income increases through the population, the other Formats are witnessing growth in volumes across both urban and rural segments with some states growing at an above average rate.

| No | Format | Challenges | Opportunities |

|---|---|---|---|

| 1 | Supermarket |

|

|

| 2 | Department Stores |

|

|

| 3 | Hypermarket |

Competitive with the presence of large corporations including:

|

|

| 4 | Discount |

|

|

| 5 | Speciality |

|

|

| 6 | Warehouse Club |

|

|